There is a wealth of options available when considering different ways to support the organization you love. Sometimes it can be hard to know where to start! Depending on your situation, certain giving options may make more sense for you than others.

Here is a categorized listing of common questions about the estate planning and planned giving processes that can help you get started.

Need someone to walk you through the process?

Find a Planned Giving & Trust Services representative near you!

What is a Donor Advised Fund?

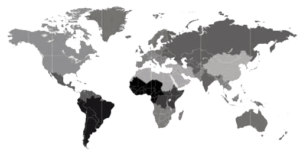

Only available in the USA

This is like a savings account created by you for the benefit the organization of your choice. Many donors find this to be a more feasible option than setting up a private foundation for their contributions.

You open this account through a sponsoring organization or public foundation, and you can use cash or other financial assets, like stock or real estate or personal property.

Opening a DAF will allow you to receive an immediate tax deduction and specifically recommend which entities, initiatives or departments benefit from your gifts. You can also add family members to your account to make these recommendations.

Each sponsoring organization has its own regulations and procedures when it comes to opening a DAF. It is best to use discretion, selecting a sponsoring organization that will support your interests and values. Your local PGTS representative can help you navigate the process and possibly recommend sponsoring organizations that work well with Seventh-day Adventist ministries.

Can I get a tax benefit now for gifts given at my death?

Varies by country

You can receive tax deductions for end-of-life gifts as long as the ownership of the money or asset is transferred to the organization you support.

Many choose to do this through charitable gift annuities or charitable remainder trusts, because you receive a tax deduction right away even though the gift isn’t given to the charity until you pass away. You can also receive income streams from these types of gifts.

You can also up a life insurance policy owned by the organization and also listing the organization as the beneficiary. You, however, are the one who is covered through the policy and the one who pays the premiums. This is a way to leverage your charitable gift so it is affordable during your lifetime and benefits the charity significantly even after you’re gone.

What kind of giving options provide regular payouts?

Only available in the USA and Canada

Yes, you can make a sizeable gift to the organization of your choice and receive an income stream based on the value of that gift for the rest of your life. You may even designate a second lifetime for the income to be received, such as adding a spouse or child. The most common options for gifts that provide income are:

- Charitable Gift Annuities

- Charitable Remainder Trusts

What is a charitable gift annuity (CGA)?

Only available in the USA and Canada

A CGA allows you to make a gift of cash, assets or valuable personal property. The organization you support then provides you with an income stream you receive throughout your lifetime, and also the lifetime of a spouse or child, if you choose to include that. (Most CGAs allow two “lifetimes” to be applied.)

A CGA is a smart choice if you want to liquidate a non-cash asset and receive income while also benefiting an organization you believe in. CGAs also have a lower minimum contribution, and your payments are in fixed amounts based on the starting value of the gift. This can eliminate risk of volatile market conditions.

What is a charitable remainder trust (CRT)?

Only available in the USA and Canada

A CRT also allows you to make a gift of cash, assets or valuable personal property and receive regular lifetime payouts and an immediate tax deduction. This option can better suit those who can make a higher minimum contribution and whose gifted assets are appreciating in value. The income payments of a CRT are variable, not fixed.

Varying payment amounts can grow with inflation, as the trust is revalued every year. There is risk involved, however, as payments can also go down based on market performance.

What are the different kinds of powers of attorney?

Varies by country

Durable general power of attorney is a comprehensive designation that gives someone you trust the right to sign documents, pay bills, and conduct financial transactions on your behalf. This power of attorney can be springing, or become effective at a certain time or at a time you are declared incapacitated.

Durable medical power of attorney allows the one you designate to sign medical papers and request or decline procedures. This is an important part of drafting a “living will,” or a declaration of your wishes should you become incapacitated while still living. You want someone who knows you, your priorities and your values to be making these important decisions.

Will I have to pay taxes after I die?

Varies by country

There are two separate types of taxes that can come into play after your death: income tax and estate tax. This is how your final tax return will be divided up.

Any income you receive before your death is taxed as it normally would be. Any income received after death up through the end of the tax year (i.e., interest or from termination of your retirement accounts) is considered estate tax.

Most won’t have to worry about estate tax. Unless the income after death is a significant amount that surpasses a government-set minimum, there is no balance due. Income tax, however, can make a big difference on the final amount awarded to beneficiaries.

One way to avoid this income tax is to make a nonprofit a beneficiary to these accounts, as they pay no tax. This creates a considerable gift to the organization you care about and allows that money to be used to its full potential. You can then leave other assets, such as bank accounts, stocks, property, etc., to your loved ones without them having to worry about these taxes.