Estate Planning: You Can’t Predict the Future, But You Can Prepare for it.

If you own anything at all, you have an “estate.”

Your estate includes your home, your car, your household possessions, your bank accounts, etc. Just about anything that has your name on it.

If you don’t already have an estate plan in place, the state/country may decide how to divide up your assets when you pass away. The probate judge will do their best to follow the laws of intestacy and divide things up as carefully as possible, they won’t know your wishes, your priorities, your spiritual convictions, or if there are any sensitive situations that might need extra care in handling.

All in all, estate planning isn’t about how wealthy you are or how old you are. It’s about being a good faithful steward with what God has given you to manage. Even if you have a relatively modest estate, you want to arrange for it to be handled carefully, with your own intentions and convictions in mind.

Working with the Seventh-day Adventist Church’s Planned Giving and Trust Services (PGTS) means you can have confidence in professionals that share your beliefs and can guide you through estate planning options that best suit your needs. Depending on your gift planning needs you may not even need to see an attorney. And even if you do, by working with our PGTS personnel before your legal consultation you’ll be better prepared and may save significant time and money.

Here’s an overview of what you need to know before seeking out a PGTS representative with the appropriate accreditations for your situation.

An Estate Plan Is More Than a Will

In its fundamentals, estate planning is all about who you want to receive or manage your assets, what you want each person to receive, and when and how they are to receive them.

Estate planning typically involves the following:

Last Will and Testament—a legal document that coordinates the distribution of your assets, both liquid and nonliquid. This can include real estate, valuable possessions, investment accounts, even potential inheritances from other relatives if you are listed in their wills. Your will can also appoint an executor of your estate, so you can leave remaining decisions to someone you trust. And if you own a business or are in a partnership, you can include language about these arrangements as well.

Beyond that, your will also states who you want to take guardianship of your minor children, and where you want your charitable gifts to go. Choosing a guardian is a decision you likely will not want the probate judge to decide for you! And when it comes to charitable giving, if you don’t have a will, the probate court won’t allow it! That’s why a will can provide peace of mind for you now, and comfort for your loved ones during an already tough time.

Trusts—official arrangements that appoints a trustee to distribute money or property to beneficiaries, according to the trust’s documented terms. Some trusts are started while an individual is still living, which will allow for the probate process to be bypassed, or a trust may be created in probate when the last will and testament is read.

Advanced Directive, Health Care Directives, or “Living Will”—an official legal document that expresses an individual’s health care desires, in the event they become unable to make their own health care decisions. While it can be difficult to think about, having an Advanced Directive can ensure important medical decisions can be made efficiently while also reflecting your wishes to those are left to make these difficult decisions.

Durable Power of Attorney—a durable power of attorney enables a third party of your choice to handle your finances if you become unable. This person can make financial decisions, manage your bills and make transactions in your name. This can help avoid conflict between loved ones as to who handles bills, cashes your checks, etc.

Leave a Legacy with a Gift

Gifts through a will—a bequest in a will or trust that designates an organization as the beneficiary. You can make a specific bequest of a sum of money, an asset or list of assets, or property. You can also donate percentages or remainders of your estate..

Life-time gifts may also be given. The advantage of life-time gifts is you will be able see and enjoy the results and how people are helped.

This popular giving option can begin with the donation of a lump sum of cash, marketable securities, a vehicle, or other valuable items.

Gifting of Retirement Assets—After making sure your family is amply provided for, you can make a charitable gift out of your remaining retirement assets. This can help you avoid passing on tax-deferred assets to your family members, who would then have to pay additional income tax.

Getting Started on Your Estate Plan (It’s Not Too Early!)

Every now and then you’ll find a person who feels they don’t have enough assets to necessitate a plan, or who “doesn’t want to worry about estate planning until retirement.”

While it’s understandable that you might not be excited or eager to get these things in order, it’s risky to put it off. And once it’s done—the hard part is over! It is much easier to update your estate plan with changes or additions than to begin the process during an emergency, when your estate is more complex, or if you feel rushed.

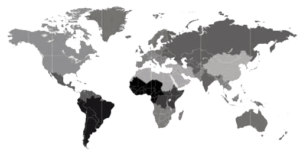

Planned Giving & Trust Services (PGTS) has professionals staffed in most mission, conference and union offices, as well as many ministry organizations such as media centers or universities. You can search for a PGTS representative near you below.

Before you meet with your representative, take these steps to document your priorities and make any special notes that will be helpful for your PGTS worker to know.

- List your aspirations for your legacy. In general terms, what desires do you have for the things you leave behind? What would you like your assets to do for those you choose to support?

- Note your wishes for your final arrangements regarding funeral plans, organ donation, etc.

- Make an inventory of your assets. Include things you totally own, partially own, partnerships, investments, real estate, bank accounts, insurance policies, personal property, liabilities, etc.

- List your beneficiaries and their information, including notes about what you would like each to have or what you would trust each one to handle. Include individuals you wish to list as guardians if you have children who are under 18.

- Note any charitable intentions. Are there organizations you wish to support? Are there any non-liquid assets that would be easier to donate to charity rather than to liquidate and disperse among beneficiaries?

- Gather official documents you may need before meeting with your representative, such as existing wills or trusts, real estate deeds, investment account information, stock certificates, etc.

- Note any complications, sensitivities, or other special circumstances in which you wish to receive counsel or recommendations from your PGTS representative. Persons with disability need to be noted so appropriate arranges may be made to provide for their needs.

Starting on your estate plan (Today is the best time!)